When you hear the word waqf, what comes to mind? For many, it’s an old concept—land donated for mosques, schools, or graveyards centuries ago. Valuable, yes, but often seen as static and disconnected from today’s pressing needs.

But waqf isn’t meant to be locked in the past. It’s a timeless idea with the power to address modern challenges—if we use it with vision. That’s exactly what myWakaf is doing in Malaysia.

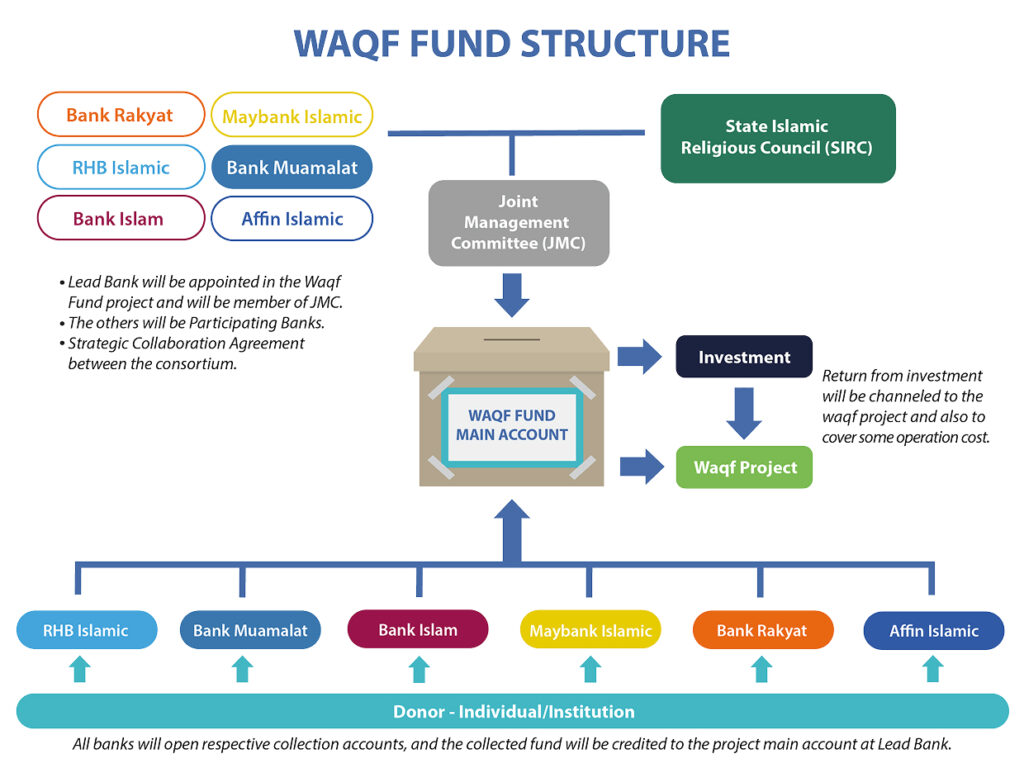

Launched in 2017 by the Association of Islamic Banking and Financial Institutions Malaysia (AIBIM), myWakaf is a collaboration between six Islamic banks and nine State Islamic Religious Councils. Instead of treating waqf as a one-off donation, myWakaf reimagines it as a structured, transparent, and impactful social finance model.

Here’s the magic in action: banks and religious councils identify projects that serve community needs—whether in healthcare, education, or social empowerment. Funds are raised through bank channels, digital platforms, and the myWakaf portal, making it easy for anyone to contribute. A joint management committee ensures accountability and Shariah compliance. Once the project is complete, it’s handed over to the community, with governance structures in place for long-term sustainability. Waqf, made modern.

The results speak for themselves. By the end of 2020, myWakaf had rolled out nine projects across Malaysia, raising RM7.32 million. In healthcare, they funded the largest dialysis centre in Perlis, drastically reducing patient waiting times. Terengganu saw a similar centre, and in Selangor, a mobile dental clinic—a double-decker bus converted into a clinic—travels to rural and underserved areas, delivering free or affordable dental care to thousands.

Education is another area where myWakaf shines. In Kelantan, a Muallaf Centre supports new Muslims with accommodation, education, and financial help. In Negeri Sembilan, an Islamic school was relocated and expanded. And in Kedah, a hostel for students doubles as a guesthouse during school breaks, generating income to sustain the school.

Community and livelihoods also benefit. In Perak, the Waqf Boat project gives fishermen access to deep-sea fishing boats, boosting productivity and income. Meanwhile, the Housing Waqf in Penang buys homes from distressed families, converts them into waqf assets, and leases them out long-term. Part of the income funds education and healthcare initiatives—helping families, creating sustainable assets, and keeping the cycle of waqf alive.

The beauty of myWakaf lies in its blend of tradition and innovation. It honors the classical spirit of waqf while addressing today’s realities: digital fundraising, healthcare needs, housing crises, and the importance of transparency. It shows that Islamic social finance isn’t just theory—it can produce tangible, life-changing impact.

Dialysis centres, mobile clinics, school hostels, fishermen’s boats, affordable housing—these aren’t small wins. They’re a blueprint for how waqf can thrive in the 21st century.

If a model like myWakaf works in Malaysia, imagine what could happen if similar initiatives spread across the Muslim world. Waqf, when combined with faith, creativity, and accountability, can transform communities in ways that were once unimaginable.

👉 If you’d like the visual version, here’s the presentation link.

Check this to learn more about that.

#Islamic_Social_Finance #Waqf #Waqf_Case #Social_Impact